Offering value-based service packages instead of individual add-ons

Background

Over the years, our team has devoted much time and energy to increasing our attachment rate (purchase of our value-added products such as windshield wipers). However, many of our ideas still revolved around the same strategy: encouraging users to “add on” these items as a separate purchase.

My role:

Lead designer & researcher

Impact:

+$5.9M annual incremental profit

+18.1% attachment rate

Tools:

Qualtrics, Maze, Figma

How might we increase VAPS attachment?

Challenges

Our strategy has always treated wipers and Rain Defense as add-ons to service, the enhancements we made to the experience only moved the needle by small amounts. Instead of keeping on this path, our team believed there was an opportunity to re-strategize our efforts and obtain big gains.

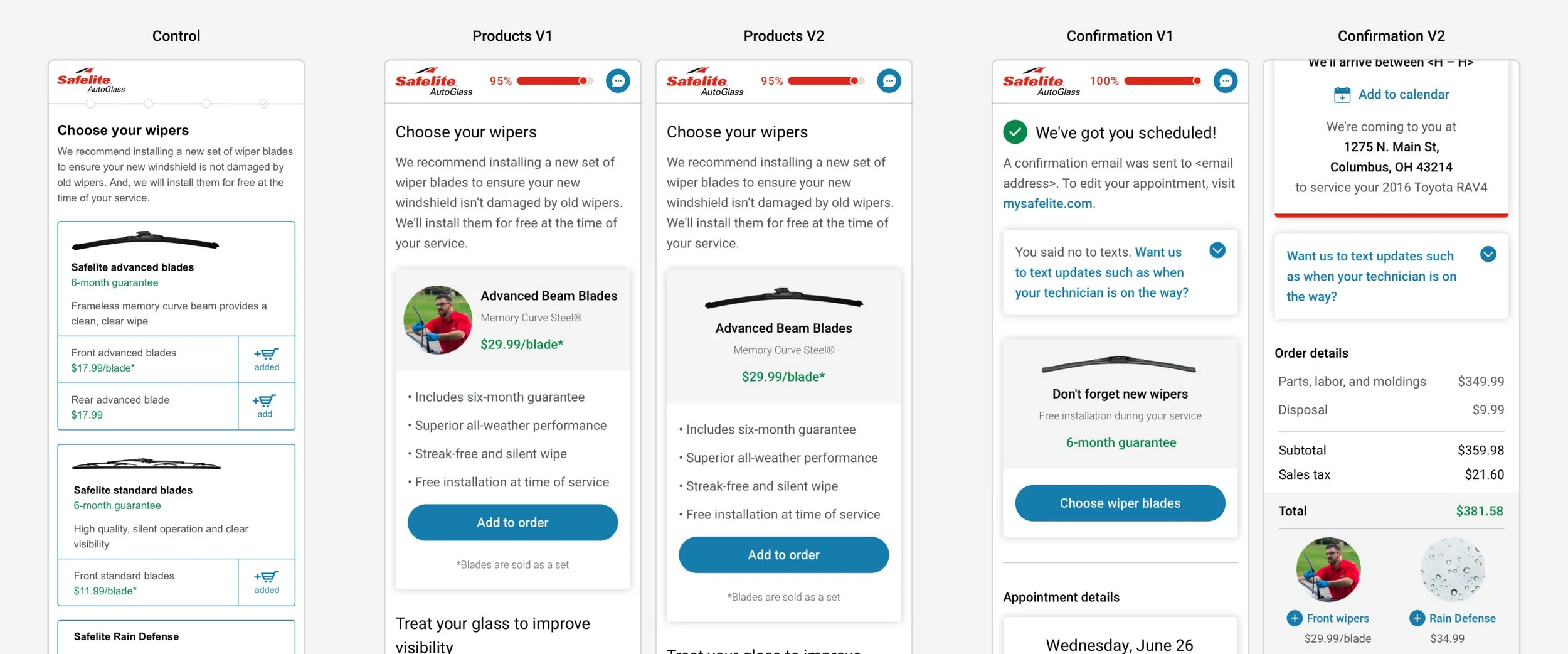

On the left: Control (Quote experience)

On the right: Test (Service packages experience)

Prior to service packages, we tested and launched various enhancements to our products and confirmation page to offer an upsell

To think outside the box, our team got together to brainstorm new, big ideas and share inspiration from other companies

What is the purchase behavior of our users?

Method:

Survey

Sample size:

600

Margin of error:

4%

Confidence level:

95%

Problem statement

Out of the brainstorming, our team gravitated toward the idea of service packages. Our hypothesis was that by offering varying degrees of value-based service packages, VAPS will be treated less as an up-sell and more as a part of standard service.

Additionally, by using this tiered service strategy, we could utilize the goldilocks effect, where our lowest tier package is “too little,” our highest tier package is “too much,” but our middle package is “just right.”

However, to understand whether this strategy would be fruitful, we needed to understand our audience’s purchasing behavior and whether it mapped onto our concept.

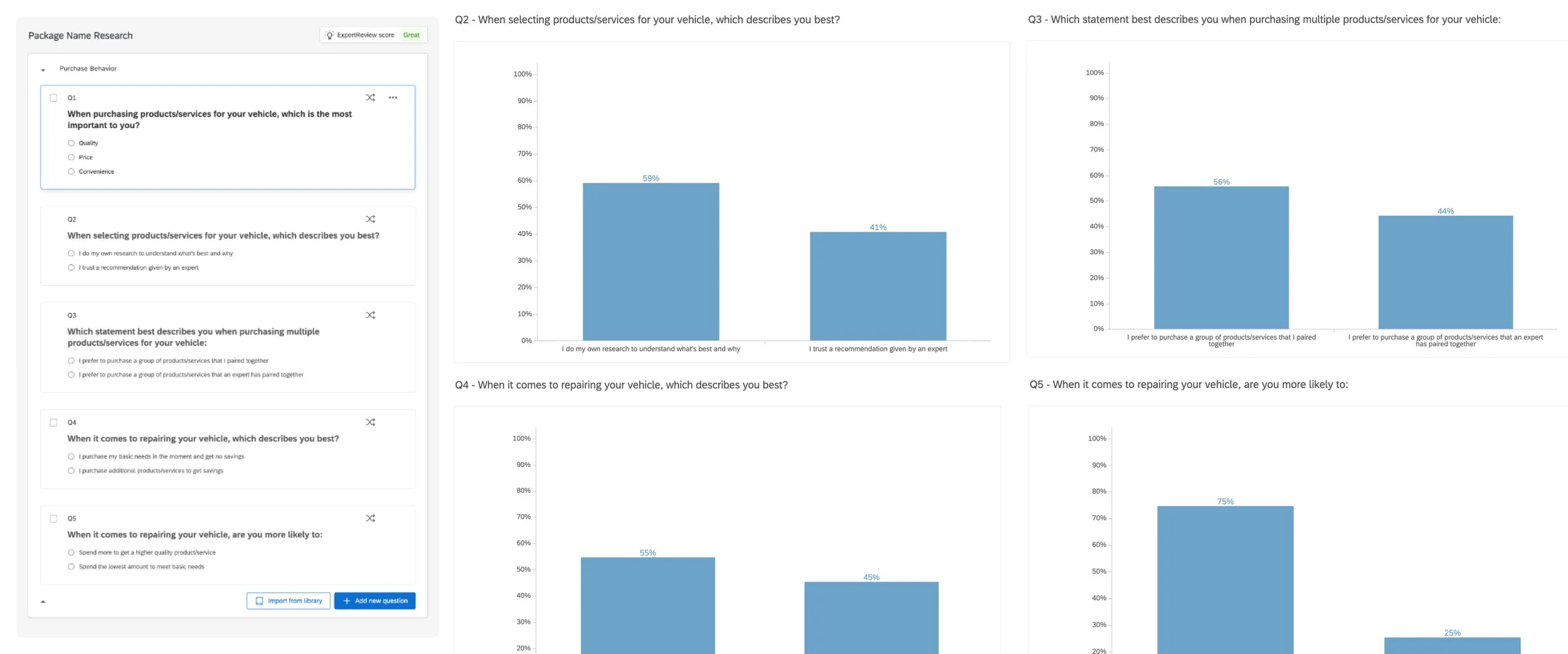

Survey results collected to validate or invalidate our new VAPS strategy

Findings

When purchasing products/services for their vehicle, the majority of users (62%) believe quality is most important compared to price and convenience

Which means: The perceived quality of packages should have a large impact

When purchasing products/services for their vehicle, 41% of users trust a recommendation given by an expert, and 44% would prefer to purchase a group of products/services that an expert paired together.

Which means: Although the majority like to do their own research/pairing, a large percentage of users look to our expertise/recommendations

75% of users would spend more to get a higher quality product/service vs. spending the lowest amount to meet their basic needs

Which means: If we provide a variety of service options, many users will be interested in the higher-quality offering(s)

Recommendations

Conceptually, the idea seemed to fit the needs of our audience and looked like it would provide guidance and confidence in the decision-making process

Next step: Dive into the specifics of the experience

What do users associate with different service names?

Method:

Survey

Sample size:

300

Margin of error:

6%

Confidence level:

95%

Problem statement

To move forward with this experience, we needed to understand what level of quality and cost users associated with different service names. This would help guide us on what to name our service packages.

Additionally, it would help us understand what perception users would have based on the words we used to describe each service.

Bar chart of the perceived quality of 20+ potential service package names

Bar chart of the perceived cost of 20+ potential service package names

Findings

Economy is perceived as the cheapest and lowest quality

Which means: This could further encourage users to select Standard service

Standard is perceived as the most average option

Which means: Users are much more likely to choose this service

Premium is the sweet spot for high-quality service

Which means: This option sits very comfortably above average, but avoids the “very/far above” labels that are attributed with names such as “Elite”

Recommendations

Understand how service names might affect behavior so we can effectively balance attachment rate and conversion rate

How do service names affect customer behavior?

Method:

Survey

Sample size:

300

Margin of error:

6%

Confidence level:

95%

Problem statement

Now that we understood what quality and cost users perceive different service names to have, we needed to understand what impact this might have on actual behavior.

To reduce cost and risk, I tested our favorite tier names to see how they performed against each other in qualitative A/B testing to give us the best shot at a successful experiment once we pushed it live for a real A/B test.

This was a crucial step in the process, as there were a lot of differing opinions from various teams and stakeholders, and research was the way to get everyone on board with a single solution that presented the best chance at success.

All of the variations tested to gauge and compare interest in upgrading (e.g. selecting a Tier 2 or Tier 3 package)

Questions from the survey which were used as a baseline to compare across all test variations

Findings

Control (Economy / Standard / Premium)

49% upgraded their package

Test A (Basic / Standard / Premium)

36% upgraded their package (–13%)

Test B (Standard / Essentials / Plus)

35% upgraded their package (–14%)

Test C (Back on the road / The Essentials / Full Service)

37% upgraded their package (–12%)

Test D (Starter / Standard / Premium)

46% upgraded their package (Flat)

Test E (Essentials / Plus / Premium)

28% upgraded their package (–21%)

Recommendations

If our first priority is to improve attachment rate:

Control and Test D variations will be most effective

If our priority is to balance attachment rate & conversion rate:

Test A, B, and C variations will have similar results to each other

Compared to the Control, these variations will likely decrease attachment rate but may improve conversion rate.

How do users react to service packages?

Method:

Unmoderated usability

Sample size:

40

Problem statement

After finalizing the tier names we wanted to move forward with, I still needed to ensure the experience would be effective. Up until this point, we’ve successfully tested the idea conceptually, but what does it look and feel like in practice?

Specifically, I needed to understand how customers might react. Can they complete tasks? Do they understand their options? Can they articulate what they’re choosing and why? Is the information clear and easy to review?

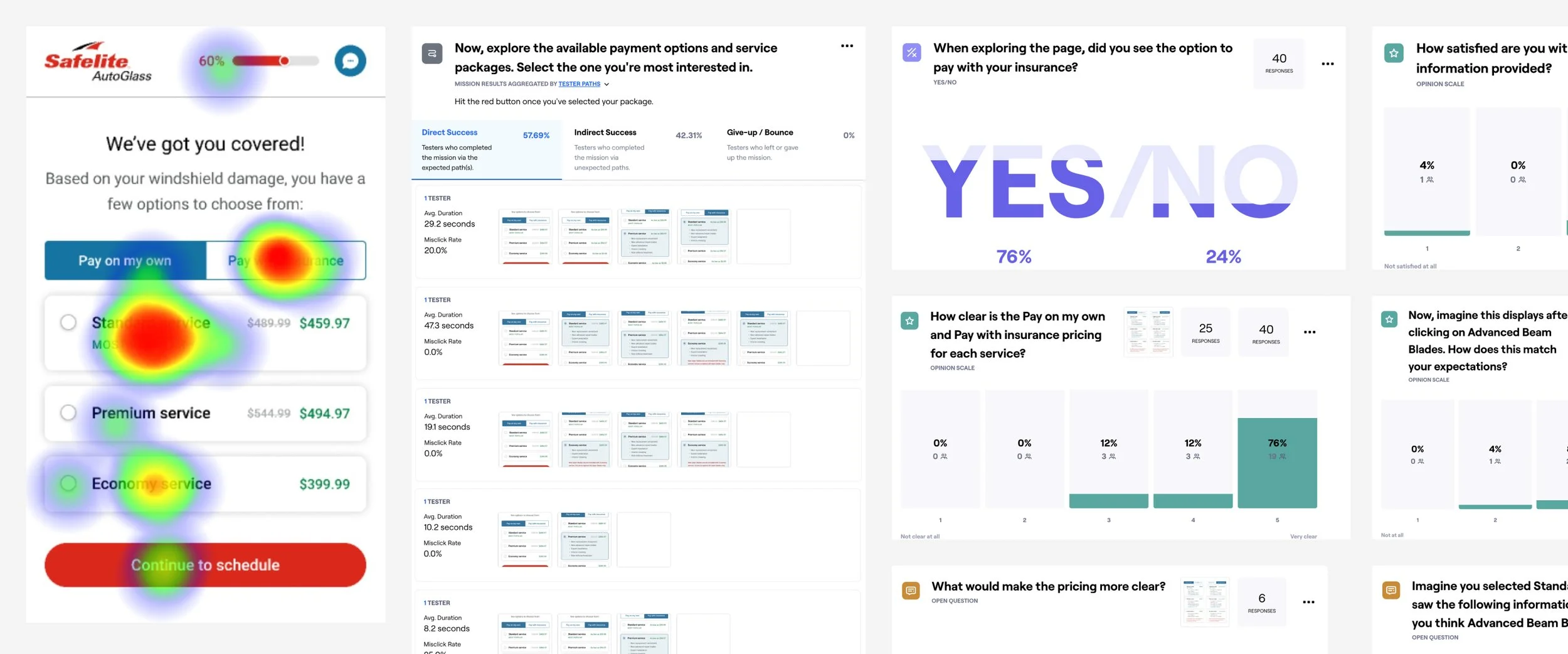

Usability findings from our unmoderated session with Maze participants

Findings

Users rated their initial reaction to the design: 4.3 out of 5

Specifically, users had a positive reaction because: (1) Price transparency, (2) Clearly laid out, (3) Variety of options, and (4) Visually eye-catching

All users (100%) successfully completed the tasks

Vast majority (96%) found reviewing the packages to be easy

Vast majority (96%) thought the benefits of each package were clear

Vast majority (92%) thought the pricing for cash/insurance was clear

Recommendations

Offer the service packages experience to our users with Economy / Standard / Premium packages.

Explore additional labels for the packages to provide further guidance (e.g. Most Popular, Best Deal, Best Rated, etc.)

Explore auto-expanding the packages on mobile to help users compare multiple packages at the same time

Impact

After finalizing the concept, language, and visuals based on our research findings, we tested the service packages experience against our Control.

Our final hypothesis was by treating VAPS less as an up-sell and more as a part of standard service, we could increase attachment rate while retaining a flat conversion rate.

Service Packages V1

Profit: $5.9M

Wiper attachment: +16.8%

Rain Defense attachment: +1.3%

From left to right: (1) initial page load, (2) Cash + Economy package selection, (3) Insurance + Standard package selection

Team

Lead Designer & Researcher: Me 👩💻

Product Manager: Lindsay Stout

UX Writer: Laura Lampe

Data Analyst: Cody Francis & Jesse Weber

Director of UX: Jordan Monson

Director of Product: Tim Simeone

AVP of VAPS: Kristen Stovell